Discover ‘Driving Dreams’, a social entrepreneurship and SDG initiative

December 17 2021

Read more

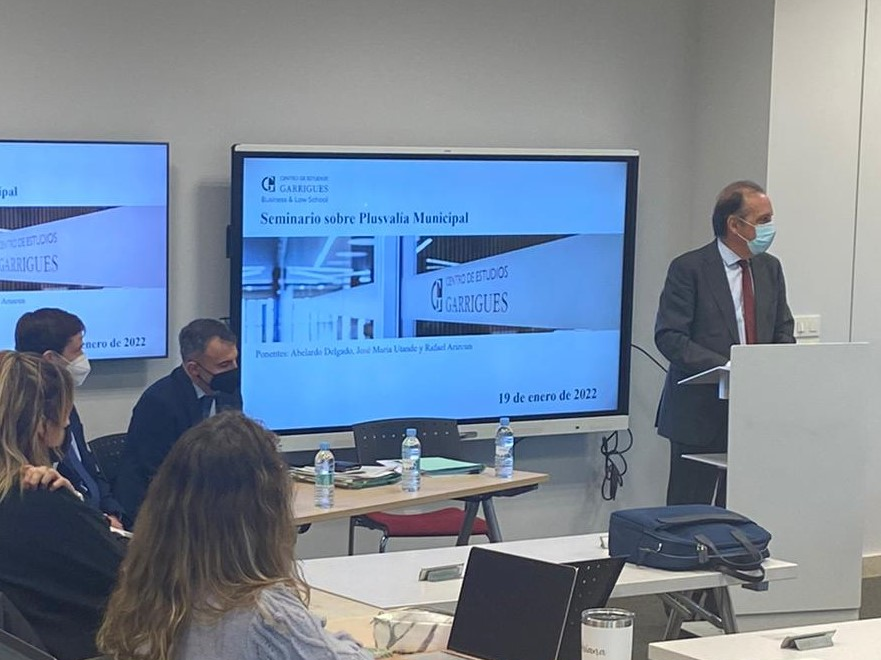

On 19 January, a seminar for students and alumni was held as part of the master’s degrees and programmes in the area of taxation at Centro de Estudios Garrigues. The speakers — Abelardo Delgado Pacheco, José María Utande, and Rafael Arizcun — analysed the current situation of the municipal tax on the increase in value of urban land, in light of Spanish Constitutional Court ruling 182/2021.

The first topic examined was the three rulings handed down by the Spanish Constitutional Court on this tax (STC 59/2017, STC 126/2019, and STC 182/2021), with the analysis focusing mainly on the principles of economic capacity and non-forfeiture.

The second topic addressed was the effects of ruling 182/2021, which declared the provisions governing the determination of the tax base to be unconstitutional and null and void. The ruling looked ahead, exhorting the legislator to create a new regulation and eliminating those provisions from our legislation; but it also looked back, limiting the effects of the nullity, without specifying the reason, implicitly taking into account the necessary financial sustainability of municipalities.

The third topic examined by the speakers was the amendment of the law regulating local taxation to adapt it to the ruling, followed by a presentation of the pros and cons of the new legislation.

According to the speakers, the most important new features were the introduction of an additional case of non-taxation for transfers in which it is established, at the request of the interested party, that there is no increase in the value of the land between the date of acquisition and the date of transfer; and the new wording of the tax base. It now provides for two calculation systems: one, by default, which is objective in nature; and the other, at the taxpayer’s request, which allows for the calculation of the increase in value that has actually been obtained.

Thank you to all who participated in this session.

Discover ‘Driving Dreams’, a social entrepreneurship and SDG initiative

December 17 2021

Read more

Centro de Estudios Garrigues hosts twenty-first national congress of law students on ‘The future ahead: outlook for the legal sector’

December 9 2021

Read more